Forex Risk Level %

Contents:

When you use leverage to have a larger trading capital, advantages of this approach also come with quite pressing risks, which is where the stop out Forex signal comes into play. Even though you can increase your prospective payouts with an increased trading capital, you’re also increasing the amount of loss that you can experience in the market. And at some point, where the existing funds on the account balance become smaller than the funds taken by the broker, a process called stop out will begin.

Once it goes below the used https://forexarena.net/, it reaches the stop out level. At this point, the broker will not just notify you about the shortage of margin funds and close your active positions until the balance is restored. So, to use margin and leveraged positions, traders need to deposit a tiny portion of their actual position. It will be a kind of service payment for the broker. However, as the new positions are open, these funds taken by a broker increase as well.

A Demo trading account not only help newcomers gain basic experience in close-to-real trading conditions but also let professional Forex traders test their theories in any chosen trading platform. The only difference with a live trading account is that with a demo account the trader’s starting career is developed through a risk free environment. A demo trading account uses “fake” money and allows beginners to gain confidence in trading without losing much capital. To avoid this, we strongly recommend that you manage your use of leverage wisely.

What is margin in trading?

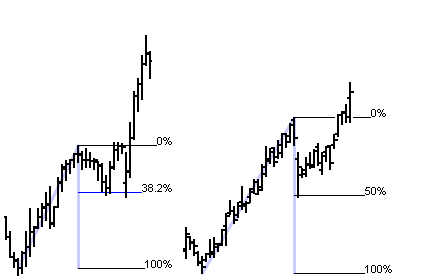

Here is an important illustration that will show you the difference between risking a small percentage of your capital per trade compared to risking a higher percentage. Learn how to trade forex in a fun and easy-to-understand format. Please email at regarding for risk management spreadsheet, then we’ll send it to you.

You can trade indexes, for example, the Dow Jones index, or rather its CFD. Precious metals may even temporarily rise in price at the beginning of a crisis, as retail traders look for assets to invest in. It was so in late 2007-early 2008, when gold and silver prices were growing despite the stock market crash.

How do I change my account leverage or margin?

By taking just a handful of steps, you can greatly increase your chances of not only survival but profitability. The ability to practice risk management is one of the few things that you can control. After all, once you place a trade, the market will do whatever it wants to. However, if you are prepared to protect your account, you can thrive over the longer term.

- On the other hand, trading is all about taking calculated risks – trying to minimise losses while maximising profits.

- It is always less risky to take your losses quickly and add or increase your trade size when you are winning.

- In other words, one trader can survive through, for example, a drawdown of 100 points, another no more than 20 points.

- This means that periods of low volatility can be particularly frustrating for traders because of the little price action that occurs.

The bottom line is this… a tighter stop loss allows you to put on a larger position size — for the same level of risk. Yes, for every trade you’ll need to adjust your position size accordingly as different pairs have different tick value, and different setups have different size of stop loss. Lastly, I explained why leverage is irrelevant because it doesn’t help you manage your risk. The only thing that matters is proper position sizing that lets you risk a fraction of your trading capital. A tighter stop loss allows you to put on a larger position size — for the same level of risk.

A better trading experience

Leverage makes it possible for traders to trade instruments that are considered to be more expensive or prestigious. Some instruments are priced at a premium and this can lock out many retail investors. But with leverage, such markets or assets can be traded and expose the average retail investor to the many trading opportunities they present. The type of market traded can also dictate the amount of leverage traders can use.

Milan Cutkovic An IB traditionally refers new traders to their preferred broker for a commission. Read more about how introducing brokers operate for Axi in this guide. Reproduction or redistribution of this information is not permitted. To enter the trade using a 1% margin rate, you place a Market Order to buy 50,000 AUDUSD @ 0.7250, which is the current market price. While leverage can help you increase your profits, it can also magnify your losses. There is a reason leverage is often called a “double-edged sword”.

Learn more about the foreign exchange.

Indeed, the company can choose between the rate it has set with its option, or the current rate which may be more advantageous. No offset in margining is permitted between a clearing member and its constituents or between different constituents of a clearing member. This is a bit ironic because it is what attracts most traders.

At this point, a https://trading-market.org/ broker sends a warning – a margin call – to a trader to refill the balance or liquidate the position. Diversification of investments is limited only by the trader’s imagination and the ability to feel and analyze the market, as well as the risk appetite. The higher is the risk, the greater is the potential profit.

Pros and cons of margin in trading

However, this is also why smaller https://forexaggregator.com/s may be preferable. Trading mini lots might be more suitable for your trading goals and risk tolerance. Of course, the opposite is also true; a decrease of 90 pips could result in a $900 loss. Remember that when trading standard lots of 100,000 units each pip movement equals about $10.

Tesla (TSLA) near support level according to Elliott Wave [Video] – FXStreet

Tesla (TSLA) near support level according to Elliott Wave .

Posted: Thu, 02 Mar 2023 17:00:00 GMT [source]

Margin Level is the ratio between Equity and Used Margin. In the example, since your current Margin Level is 250%, which is way above 100%, you’ll still be able to open new trades. Aside from the trade we just entered, there aren’t any other trades open. You want to go long USD/JPY and want to open 1 mini lot position. This means that when your Equity is equal or less than your Used Margin, you will NOT be able to open any new positions.

Forex Markets Quiet in Asian Session, Risk-On Sentiment Appears to Prevail – Action Forex

Forex Markets Quiet in Asian Session, Risk-On Sentiment Appears to Prevail.

Posted: Fri, 03 Mar 2023 06:26:27 GMT [source]

Get tight spreads, no hidden fees, access to 12,000 instruments and more. Get tight spreads, no hidden fees and access to 12,000 instruments. Needs to review the security of your connection before proceeding. You can request a change to your level of leverage by accessing MyAccount. I understand that residents of my country are not be eligible to apply for an account with this FOREX.com offering, but I would like to continue.

Last updated: Março 4, 2023

Comments